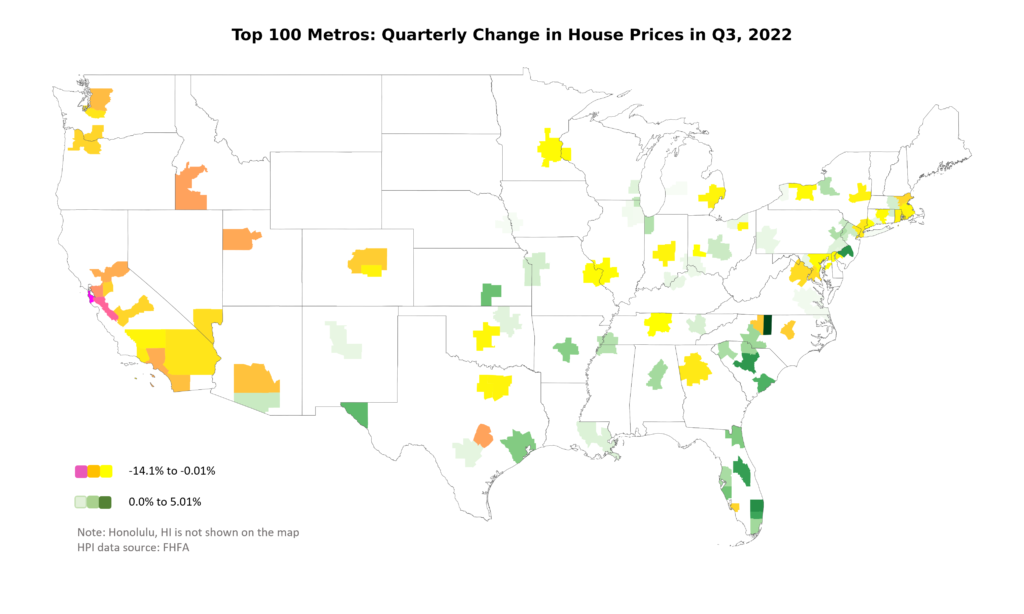

Average house prices across the US increased marginally by 0.05% from Q2 2022 to Q3 2022. Looking at the largest 100 metros, 48 posted q-o-q declines in Q3 2022 (FHFA), while the remaining recorded increases. The largest quarterly declines were in the western metros: San Francisco-San Mateo-Redwood City, CA (-14.11%), San Jose-Sunnyvale-Santa Clara, CA (-8.53%), Oakland-Berkeley-Livermore, CA (-5.93%), Boise City, ID (-5.14%), and Austin-Round Rock-Georgetown, TX (-5.08%). Metros with the largest increases were in the eastern states – Greensboro-High Point, NC (5.02%), West Palm Beach-Boca Raton-Boynton Beach, FL (3.69%), Camden, NJ (3.59%), Columbia, SC (3.52%), and Orlando-Kissimmee-Sanford, FL (3.38%). There are clearly regional variations in price trends in the housing market. These differences can most likely be attributed to affordability; the western markets have become out of reach for many, while metros in Florida and South Carolina are relatively more affordable and are therefore seeing more buyers. Demand has dropped across the board relative to what was seen earlier this year but so has supply, and it is because both demand and supply have dropped that prices have not crashed.

The housing market felt the immediate impact of the Fed’s interest rate policy. As mortgage rates shot up from 3% to 7%, demand dried up fast since many potential homebuyers were priced out of the market. At a 3% mortgage rate and 20% down payment, if a family could afford a $500,000 mortgage earlier in the year, with a 6.7% rate they can now only afford a $325,000 house. There are others in the market who can afford the house but are concerned about the economic outlook and are wondering if they should wait for rates to drop. Yet, there is another group of buyers that is willing to buy but does not like what is on the market because the inventory is so low. So, some buyers are choosing to wait and watch until they feel the time is right.

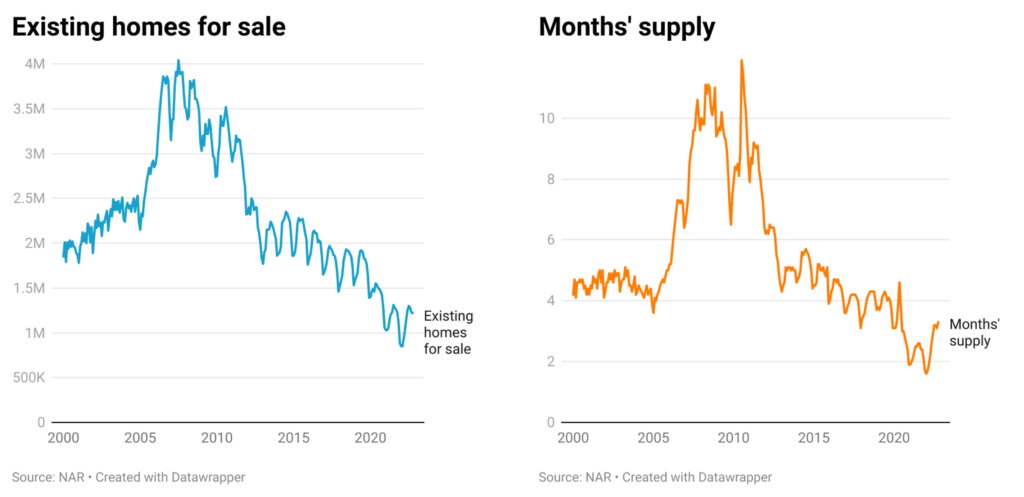

One would expect that reduced housing demand would pull down prices significantly. But the low inventory that is available for sale is what is preventing house prices from a steep decline. Higher mortgage rates have not only impacted demand but have also frozen up supply. Many homeowners refinanced their mortgages when the rates were low or bought homes at the low rates of 2.5-3.0% and are therefore unwilling to trade in these rates for the higher 7% rates. Homeowners are also finding out that they can no longer attract multiple offers and if they do not price their houses right, then they are unlikely to find buyers soon. That supply has been impacted by higher rates is evident from the months’ supply and existing homes for sales numbers. Both supply indicators are below or are at the same levels as their pre-pandemic levels and much lower than the figures observed in 2006-08. For instance, months’ supply of homes was at 3.3 and inventories were at 1.22 million in October 2022 compared to 4.0 and 1.77 million respectively in October 2019 (pre-pandemic) and around 10 and 3.5 million respectively in 2008. This suggests that a price decline of the magnitude seen in 2006-08 is unlikely.

There are varying forecasts about where the housing market is headed next year. Some are predicting prices to depreciate by 20%, while others are forecasting smaller declines, and few are calling for an increase in prices. Veros predicts that average prices across the US are most likely to register single digit declines during 2023, with variations across different regions depending on the relative strength of demand vis-à-vis supply in each market.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.