Throughout the second half of 2022, the housing market was characterized by persistently low inventory levels and diminished affordability owing to high prices and mortgage rates. Due to the low supply, the market did not crash as some had expected. On average, home prices across the country declined -0.63% from June 2022 to January 2023. However, there were large variations in regional trends, with the Pacific and Mountain regions posting declines of -4.5% and -4.2% over the same period, while the South Atlantic region recorded a 0.85% gain (FHFA).

Given these key trends and the diverging regional patterns of the past several months, what can we expect from the housing market in the upcoming spring season? There is considerable uncertainty in the market regarding the direction of the economy, and there is speculation about the timing and severity of a potential recession. The current state of the housing market has resulted in cautious behavior on the part of both buyers and sellers. Specifically, sellers have been found to be hesitant to relinquish their 3% mortgages, while buyers are opting to abstain from the market due to a confluence of factors, including elevated mortgage rates and persistently high home prices.

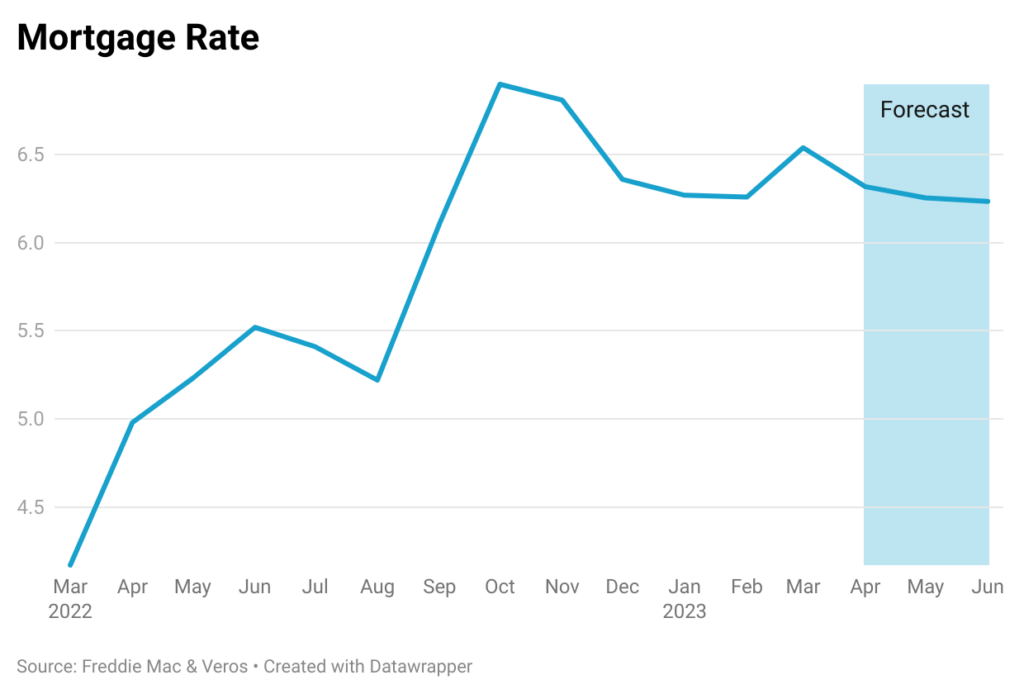

Based on our forecasts, it is anticipated that mortgage rates will persist at elevated levels ranging between 6.0% and 6.5% during the second quarter of 2023. Moreover, uncertainty regarding the banking sector and potential shifts in macroeconomic conditions, the potential for rate fluctuations remains a possibility, which could further impact the already subdued levels of affordability in the housing market. It is worth noting that the housing market witnessed an uptick in buyer activity during the month of February, coinciding with a dip in mortgage rates to around 6.1%. This suggests that prospective homebuyers are highly sensitive to interest rate variations and are likely to respond positively to more favorable borrowing conditions.

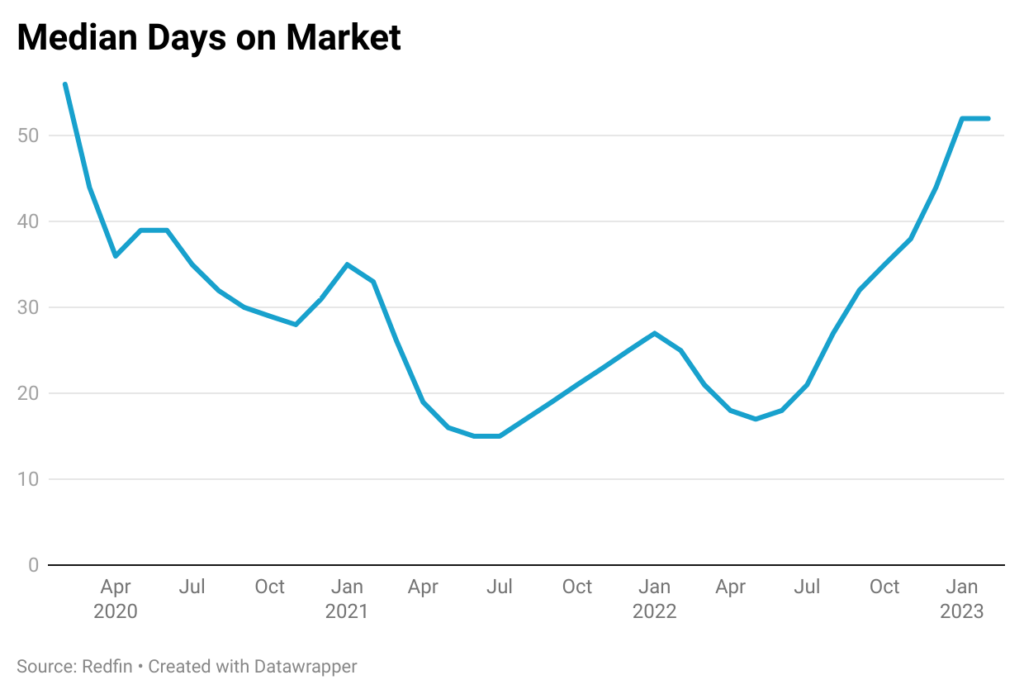

An important indicator that underscores the waning demand is the metric of days on market. This quantitative measure has exhibited a steady upward trend since May of 2022, when the median for days on market stood at 17. However, this figure has since risen to 52 as of January 2023. Despite the prevailing dearth of supply, residential properties are on the market for longer periods, indicative of a subdued buyer sentiment.

The low level of inventory is reflected in the months’ supply, which stood at 2.6 in February 2023. Although the current metric represents an increase from the 1.7 level observed a year ago, it remains significantly lower than the pre-pandemic levels. The scarcity of available housing inventory is also corroborated by the number of existing homes available for sale, which was at a mere 980,000 in February 2023. This measure reflects a significant decline from the 1,460,000-level recorded in February 2020, further highlighting the ongoing shortage of housing inventory. Additionally, with the low unemployment rate and the substantial equity that homeowners have accrued, the foreclosure rate is low.

The spring season has traditionally witnessed a surge in activity in the housing market; however, the current scenario presents a discernible decrease in the volume of buyers and sellers in comparison to preceding years. Sellers are no longer receiving multiple offers above the asking price and should, therefore, be willing to list their homes at reasonable prices that reflect the state of the current market. Buyers are finding that they have a slightly more advantageous position and are no longer under pressure to make an immediate decision to purchase a home. They are not encountering the same level of competition as buyers in 2021 and 2022. However, it will prove to be difficult for potential home buyers to time the market with respect to interest rates and neither can they expect prices to fall in a significant manner. It appears that the housing market has bottomed out based on the most recent VeroFORECASTSM, which is predicting that house prices will stay flat on average across the country over the next twelve months. This is an improvement over the previous quarter’s forecast that had predicted an overall decline of -0.5%. The strength of the housing market will hinge upon the extent of seller participation and the trajectory of interest rates. The housing market is seeing an uptick in the number of new listings, sales of pre-existing homes, and the proportion of pending sales, which is indicative of a market sentiment that is picking up. Nonetheless, the season of 2023 is unlikely to replicate the heightened levels of activity experienced in 2021 and 2022.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.