Eric P. Fox – Chief Economist, Veros Real Estate Solutions

Drew Rumfola – Economics Intern, Veros Real Estate Solutions

There continue to be some economists, real estate experts, media, and others who state that today’s housing market is in a bubble much like it was in 2005-2006 and getting ready to crash. To be sure, house prices during both periods accelerated rapidly. From 2005Q2 to 2006Q1, prices on average in the US went up 10.0% (which is approximately 8.0% when adjusted for inflation) and is now running around a 19.0% annual increase (which is 14.5% when adjusted for inflation). So prices are increasing even more rapidly now than they were back in 2005-2006!

However, the market is fundamentally different now than it was back in 2005-2006. Here are the Top 5 Reasons why today’s hot housing market is nothing like the hot housing market that existed during the real estate bubble of 2006

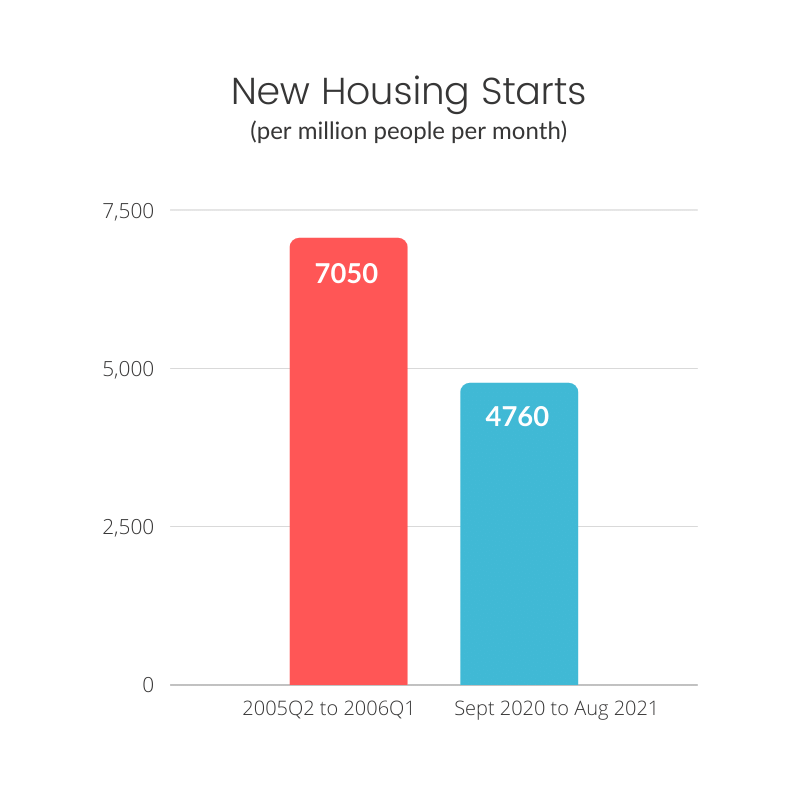

1. Builders are simply not building enough.

New Housing Starts today are down significantly from what they were in 2005-2006 …

From 2005Q2 to 2006Q1, there was an average of 7050 new housing starts per million people per month. In the past 12 months, that number has plummeted to 4760 … a 32% decrease in supply! Builders are simply not building enough new homes to satisfy the historical demand. This is partly due to builders being reluctant to increase supply after what happened to them when they overbuilt over a decade ago but is also due to Covid-related supply chain issues making it difficult to obtain building supplies to fulfill the demand.

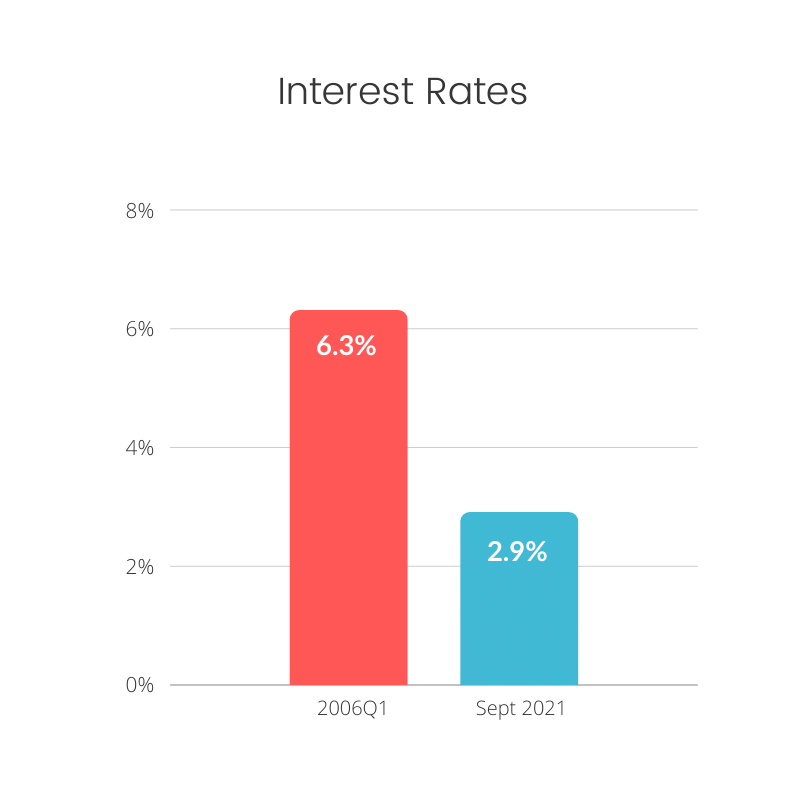

2. Extremely low mortgage rates remain attractive.

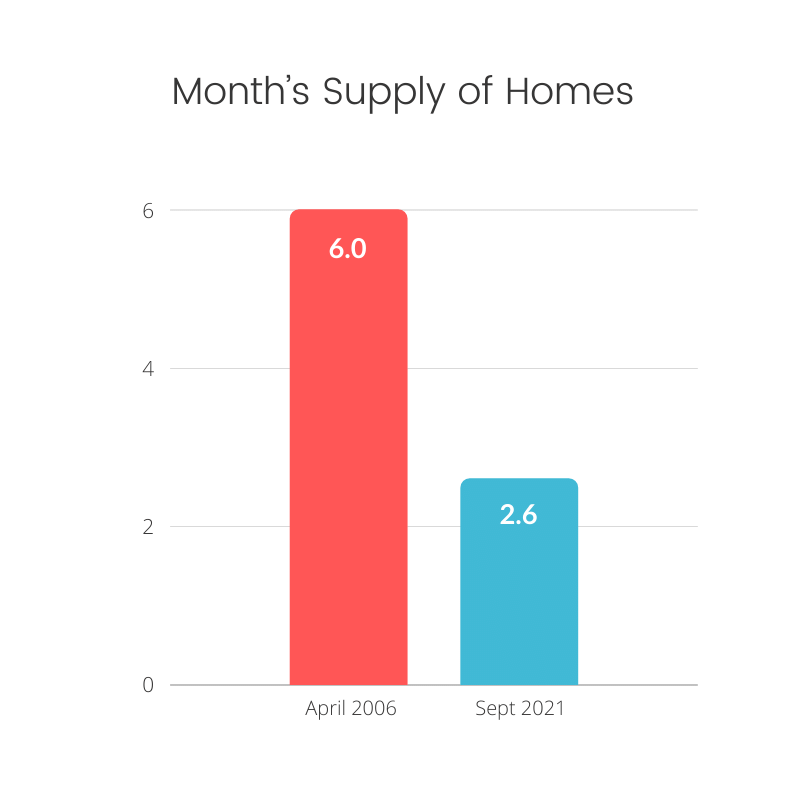

3. Today's housing supply is much lower.

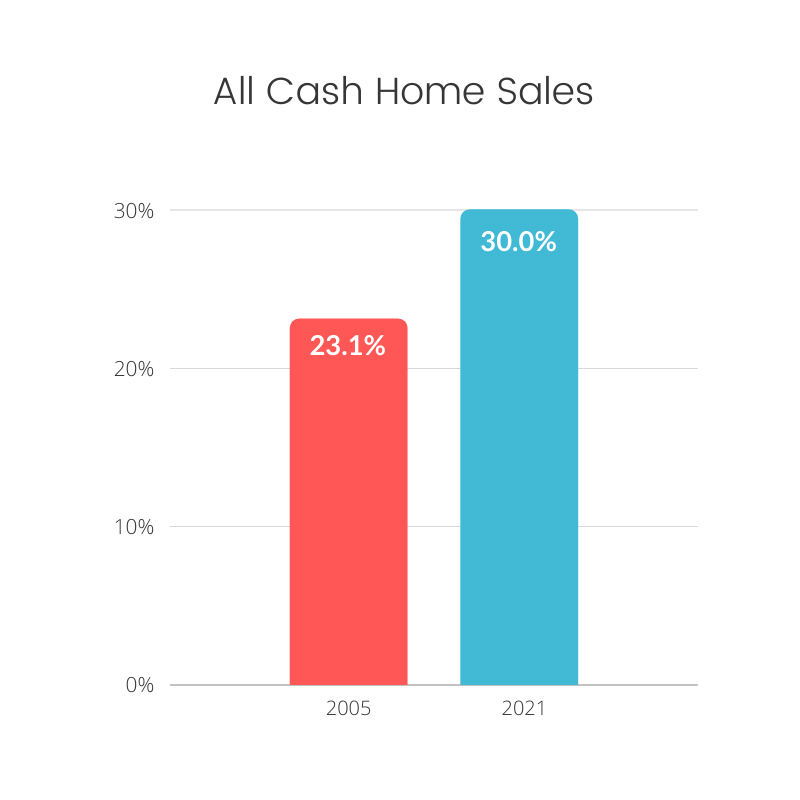

4. More all-cash buyers today.

Buyers purchasing their home with only Cash is nearing an all-time high today …

During 2005, 23.1% of buyers purchased their home with an all Cash transaction. Today that number is 30.0%. This clearly shows that the number of buyers in a very strong financial position is much greater than it was back during the housing bubble.

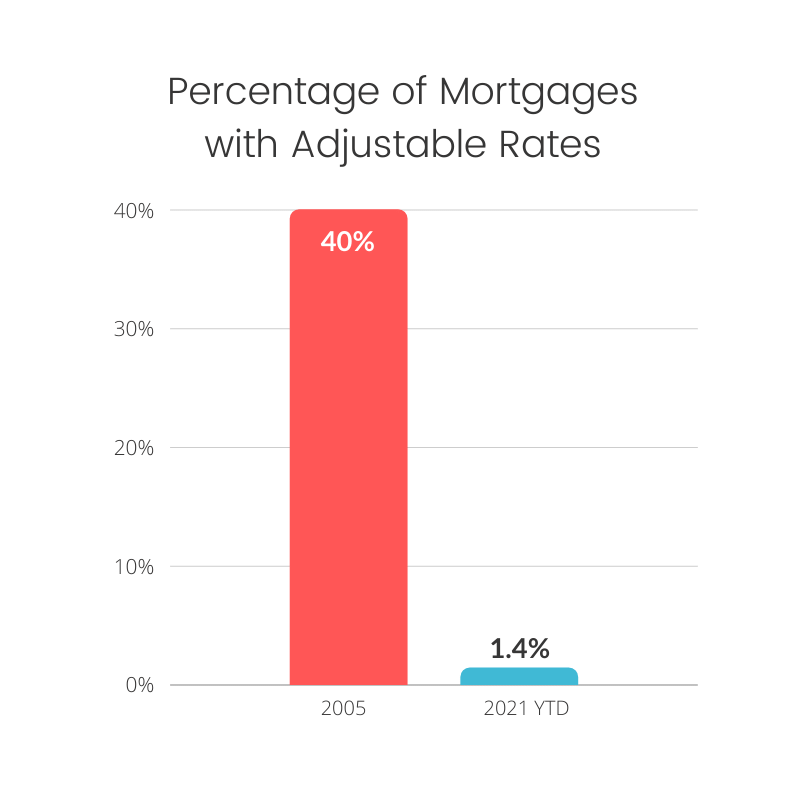

5. Use of Adjustable-Rate Mortgage Loans (ARMs) is very low today.

The use of adjustable rate mortgages with today’s buyers is almost non-existent compared to during the bubble …

During 2005, 40% of buyers used adjustable rate mortgages compared to just 1.4% today! This shows during the bubble, buyers were very stretched to be able to afford the monthly mortgage payment and had to finance with a lower rate, but riskier, mortgage whose payment would likely increase in the future. That is not the case today.