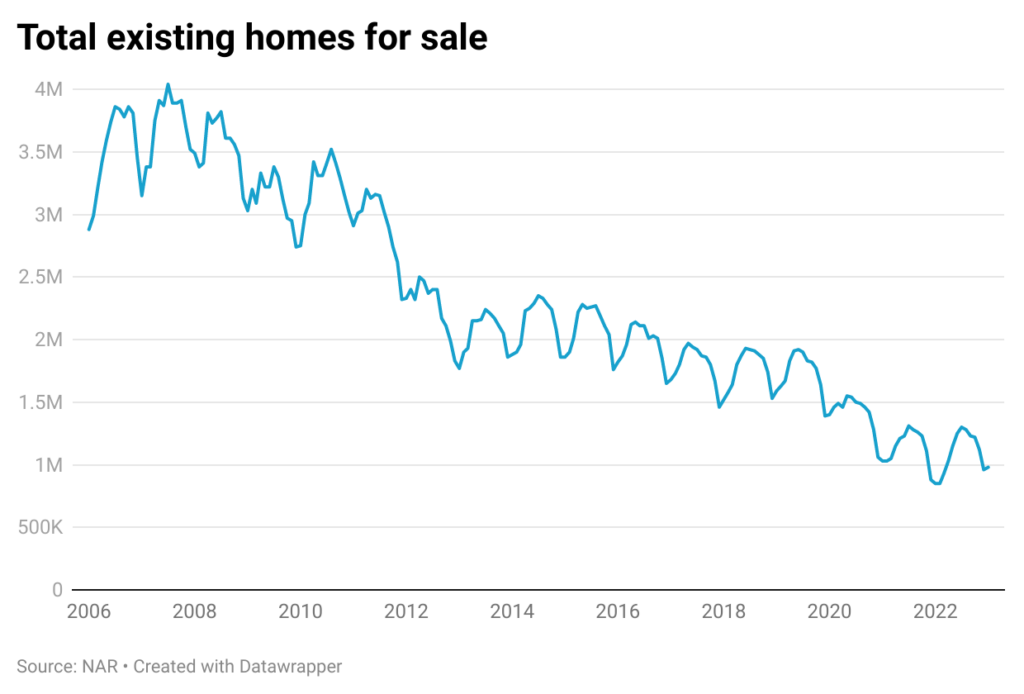

The recent slowdown in the housing market is just that, a slowdown and not a crash. The housing market situation is fundamentally different from that during the great recession of 2008. One of the key reasons why house prices have not declined significantly is because of the very low inventory of homes available for sale. There were fewer than one million existing homes available for sale in January 2023 compared to over 3 million in any month during 2007–2008.

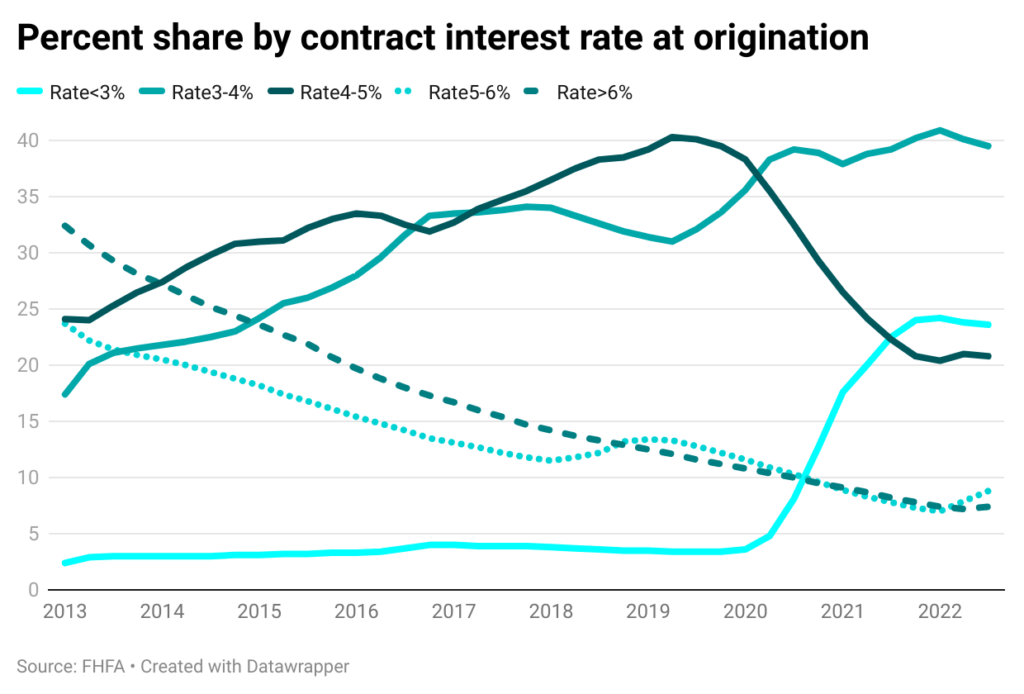

Supply remains low because homeowners are staying put. Many homeowners are choosing to stay in their homes longer because they bought homes when interest rates were low, or they refinanced their existing mortgages at lower rates. Data from FHFA shows that the percentage of mortgages with a contract rate of less than 3% increased sharply from 4.8% in Q2 2020 to 24% in Q4 2021. This can be ascribed to the fact that during the latter half of 2020 and the initial quarter of 2021, the 30-year fixed mortgage rate was less than 3%. As a result, homeowners leveraged this opportunity and chose to refinance their existing mortgages, thereby facilitating lower mortgage payments.

Similarly, the percentage of mortgages with a contract rate of 3-4% increased substantially from 31% in Q2 2019 to over 38% in Q2 2020. This is because the 30-year fixed mortgage rate slipped below 4% in May 2019 and stayed in the 3-4% range until mid-2020, when it fell further. As of Q3 2022, around 84% of all mortgages have a contract rate of less than 5%, which is almost 2% lower than the current mortgage rate. Assuming a 20% down payment, the monthly payment for a $400,000 house would be $1,550 at a 3.0% interest rate, $1,918 at a 5.0% interest rate, and $2,265 at a 6.7% interest rate.

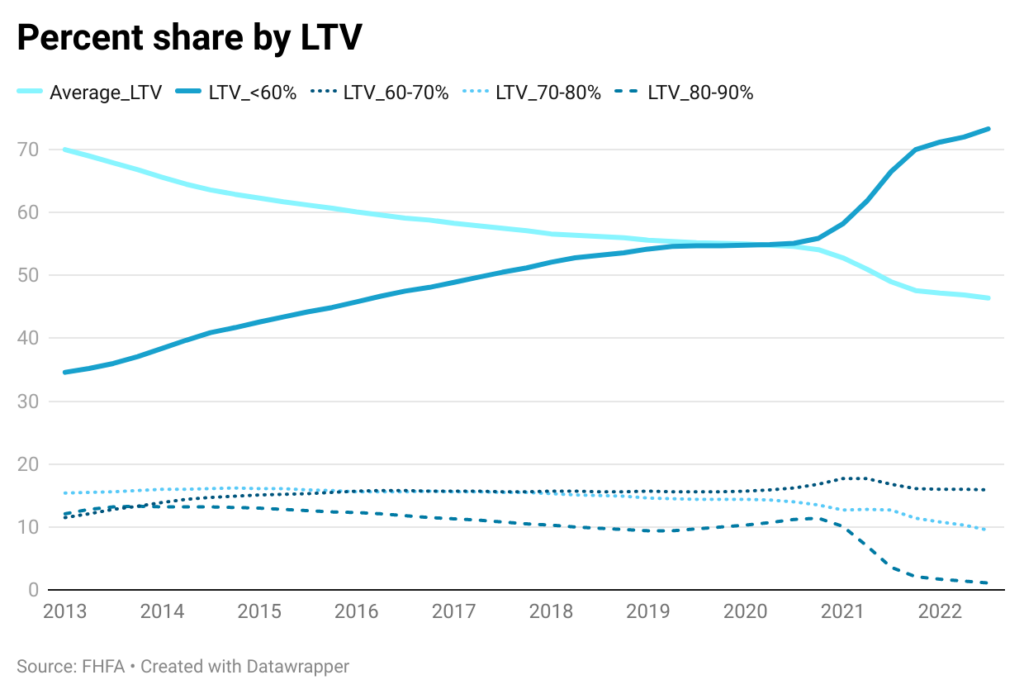

Further, loan-to-value (LTV) ratios for mortgages have declined as homes continue to appreciate in value. Borrowers have options available to them if they have equity in their homes but get into financial trouble. They can sell their home, get a Home Equity Line of Credit, or refinance their mortgage. All of this has led to much lower foreclosure rates compared to the crash of 2008. The average LTV ratio declined from 55% in Q1 2020 to 46% in Q3 2022. Over the same period, the percentage of mortgages with LTV of less than 60% increased from 55% to 73%. Homeowners have built larger equities in their homes, so that foreclosure rates are low, which has further kept supply low.

Another reason for the low housing inventory is that investors, trying to cash in on an appreciating market, have been buying up inventory either to rent or flip, thereby reducing the number of available homes for sale to traditional homebuyers. This trend is evident in Redfin data, which indicates that during the third and fourth quarters of 2021, investors acquired more than 17% of single-family homes. When investors buy homes to rent them out, those homes are taken off the market for sale, which decreases the number of homes available to homebuyers. Second, when investors purchase homes with the intention of flipping them for profit, they may make repairs or renovations to the home, which can take the property off the market for an extended period of time. Finally, investors often have the financial resources to outbid traditional homebuyers, which can drive up prices and make it more difficult for traditional homebuyers to purchase a home in a competitive market.

The current state of the housing market in the U.S. is a topic of considerable interest among industry experts, homeowners, and potential homeowners. Despite a healthy job market and shifting demographics that are fueling demand for housing, prospective homebuyers have been hesitant to enter the market due to rising mortgage rates. From mid-June to the end of 2022, there was a 40% drop in pending sales across the United States, which is an indication of how higher rates have affected demand. However, we have not seen any drastic reduction in home prices. The impact of low demand for housing has been offset by the limited availability of housing inventory, which has kept home prices relatively stable. This observation is supported by the findings of the VeroFORECAST, which predicts that the average decline in home prices across the U.S. in 2023 will be minimal, around 1%.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.