The global economic fallout from the Ukraine war is expected to negatively impact several countries, especially those that are large importers of commodities from Russia and Ukraine. While Ukraine will be the hardest hit both economically and in terms of the humanitarian crisis, the economic and financial sanctions imposed on Russia will not only severely impact its economy, but it will also have spillover impacts on other nations as well. Since Russia is one of the largest exporters of petroleum, the most immediate effect of the war and sanctions is expected to be a rise in oil prices.

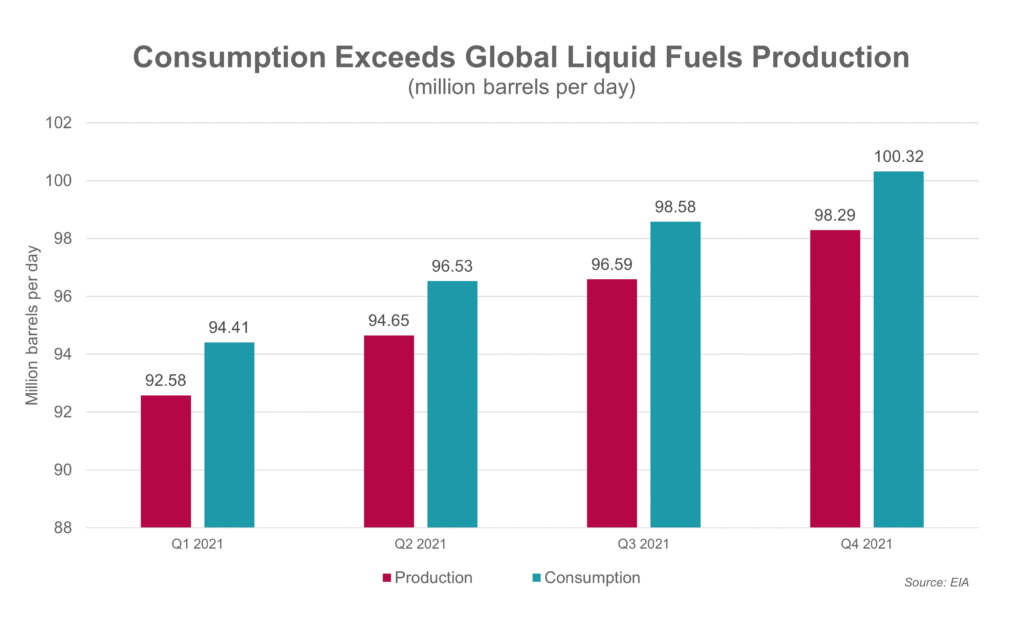

The war comes at a time when countries around the globe are still recovering from the economic disruptions caused by the pandemic, in particular the supply chain shortages and inflation. When COVID-19 hit in early 2020, demand for a broad range of commodities and services plummeted, resulting in a shrinkage in entire industries. Fast forward to 2022, demand has surged while supply is still playing catch-up. One such industry is the crude oil industry. During the early months of the pandemic, when stay-at-home orders were enforced around the world, demand for crude took a big hit and crude prices even went into the negative territory for a while as producers struggled to store inventories. To shore up prices, oil producers, the OPEC+, sharply cut back their production.

Even before the start of the Ukraine war, crude prices were high as its supply was below demand, and inventories of crude around the world were running low. With Russian crude supply now under economic sanctions from some countries, oil importers are looking to the other cartel members for crude oil to make up for the supply from Russia. The degree to which these other oil producers respond to the current market situation will determine where crude prices go. Since crude prices are determined by the global supply and demand, everyone including the US now faces higher crude prices, even though the US imports only around 7% of its petroleum from Russia. Higher crude will result in higher shipping and transportation costs, and higher production costs for any industry that uses petroleum or its biproducts as inputs. For the housing industry, building material supply constraints can be expected to amplify and construction costs will likely go up. This means that construction of new homes will likely become more expensive, and their supply might take longer to enter the market.

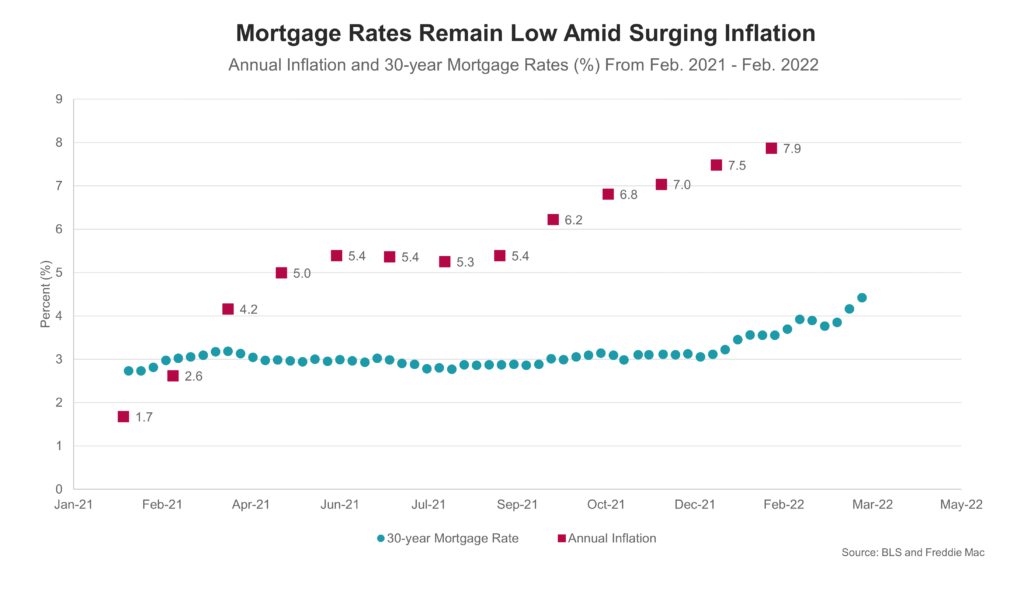

Further, due to the uncertainty in the financial markets resulting from the war, the Federal Reserve decided to increase interest rates by only 25 basis points and end its quantitative easing program at its policy meeting on March 15th-16th, while before the war it was widely expected that the interest rate hike would amount to 50 basis points, to curtail inflation. Inflation in the US has been well above the Fed’s benchmark rate of 2% for the past year and reached 7.9% in February 2022, while mortgage rates remained under 4%. With the 25-basis point hike in interest rate, mortgage rates are now up to 4.4%, but are still low enough to attract home buyers. Home prices will also continue to be supported by low inventories, demographic demand, historically low unemployment rates, work from home options and the savings accumulated during the pandemic. Buyers and investors are also getting pulled into the real estate market because of its attractiveness as a hedge against inflation; an average U.S. house price appreciation of 17.5% (fhfa.gov) versus a 7.9% inflation rate will keep the housing market a good investment strategy. In addition, renters are expected to face rising rents due to inflation, whereas mortgage payments are often fixed.

So, what is likely to be the impact of the war on the US housing market? Not much for now unless the war gets dragged out and consumer and investor confidence get impacted so much that it impacts economic activity. For the time being, the war will likely amplify the supply chain disruptions and add to the already high inflation resulting from the pandemic, and home prices in the US are likely to stay on their upward trajectory.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.