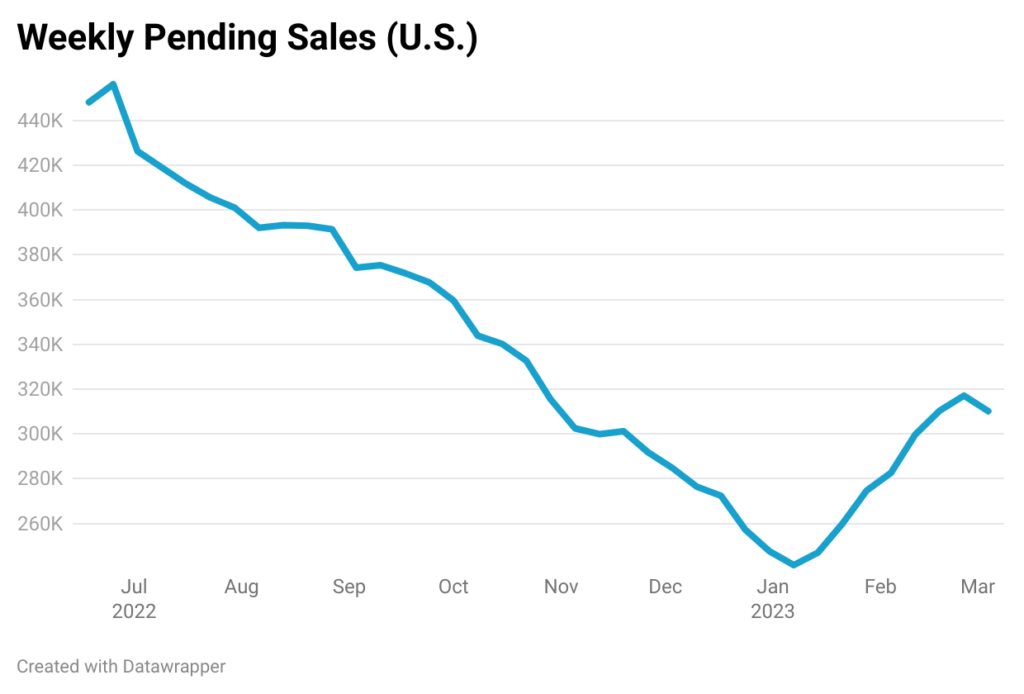

The 30-year fixed mortgage rate increased from 3.2% in January to 5.09% in the beginning of June, and to 7.08% in November, leading to a cooling of the housing market. High home prices coupled with high interest rates made purchasing a house increasingly unaffordable. As a result, demand for home purchases fell. Pending sales across the United States, based on data from around 280 multiple listing services, decreased by over 40% from mid-June to the end of 2022.

Expectations of an economic slowdown due to the Federal Reserve’s multiple rate hikes in 2022 and hopes that inflation was finally being reined in led to a dip in mortgage rates from 7.08% in November 2022 to 6.09% in February 2023. In response, buyers started coming back to the market in January and February as home affordability improved. As a result, there was a notable increase in pending sales, which increased by nearly 11% month-on-month in January and 15% month-on-month in February. However, recent indications that the Fed might need to be more aggressive in the fight against inflation has pushed mortgage rates back up. The 30-year fixed mortgage rate rose to 6.65% in early March 2023 and is expected to go even higher. As expected, the housing market cooled and experienced a 2% decline in pending sales in the first week of March.

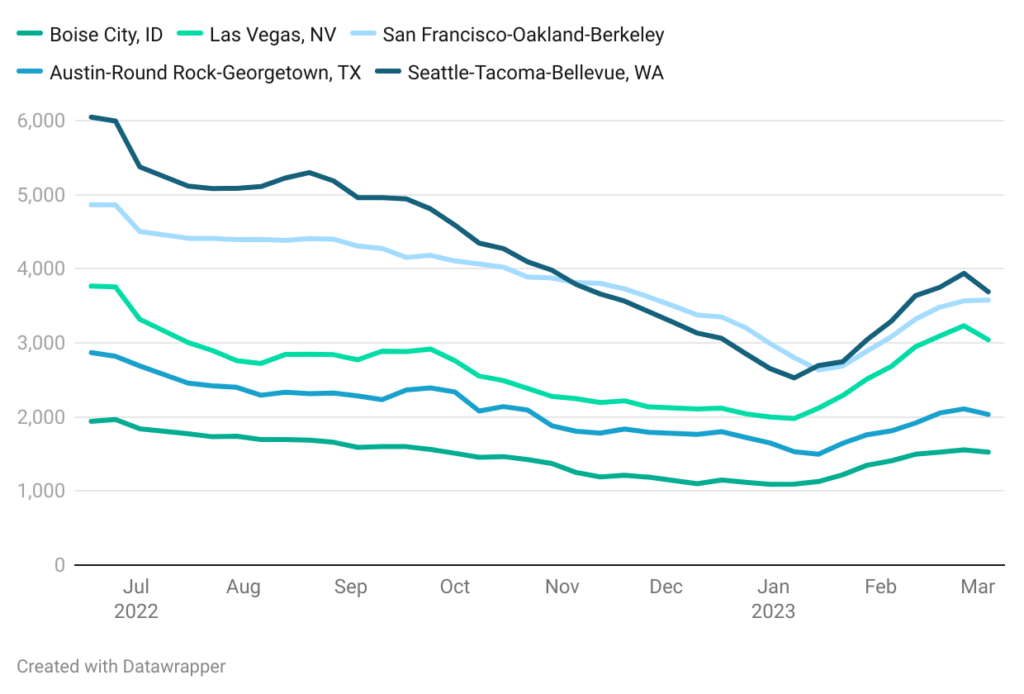

The trend of declining pending sales in the latter half of 2022, followed by an uptick in January and February, was observable in most metropolitan areas. However, the magnitude of change differed from area to area. An examination of some of the regions anticipated to underperform in 2023, per VeroFORECASTSM, reveals that pending sales fell by more than 55% in Seattle-Tacoma-Bellevue, WA; 47% in Las Vegas, NV; 44% in Boise, ID; 43% in Austin-Round Rock-Georgetown, TX; and 39% in San Francisco-Oakland-Berkeley, CA. The increase in pending sales during January and February was as high as 60% in Las Vegas, NV, and only 20% in San Francisco-Oakland-Berkeley, CA. For relative comparison, the nationwide rise in pending sales was 28%.

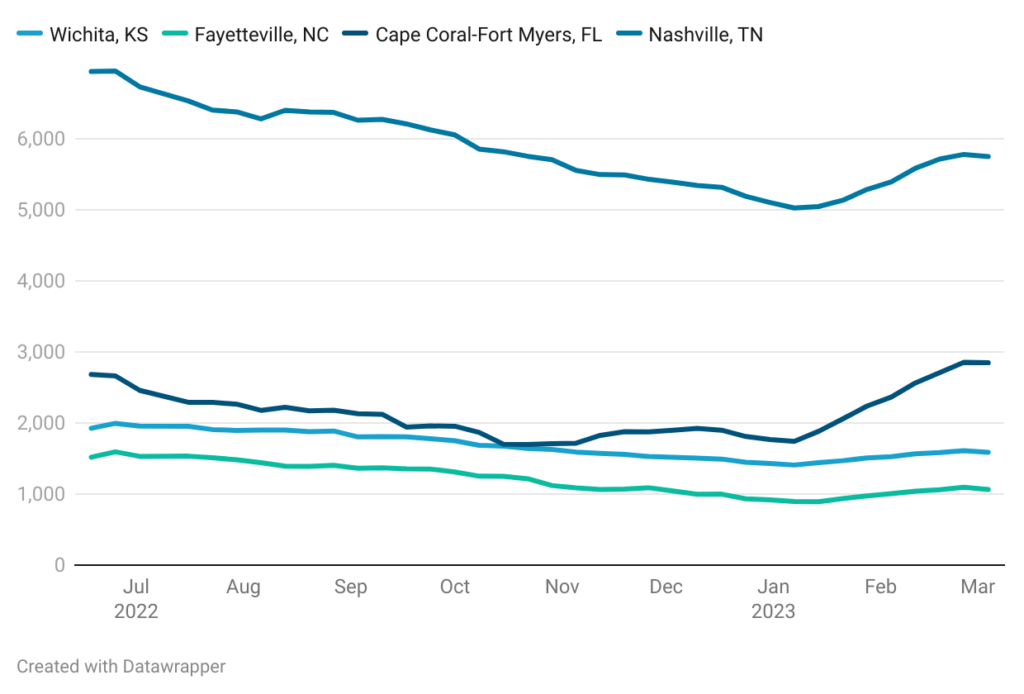

By contrast, the extent of the decline in pending sales during the second half of 2022 among the metros that are expected to be the best performers in 2023, according to the VeroFORECAST, was much less dramatic. For example, pending sales declined by only 34% in Coral-Fort Myers, FL; 27% in Nashville, TN; and 26% in Wichita, KS. Following the reduction in mortgage rates, there was a 62% increase in pending sales in Coral-Fort Myers, FL, whereas in Wichita, KS and Nashville, TN, the increase was only 13%.

The trajectory of mortgage rates has been on an upward trend since February 2023. This may continue in light of key economic indicators such as strong job growth and higher core inflation. These expectations have led to a resurgence in mortgage rates, nearing 6.7%. Subsequently, home buyers are once again withdrawing from the market. Pending sales have begun to decline, which is also corroborated by mortgage application data that reached a 28-year low in late February. The short-lived revival in the housing market seen in the initial months of 2023 has presently come to a standstill. As we approach the spring housing market season of 2023, it is worth considering what to expect. Most sellers are anticipated to remain rate-locked and hesitant to sell their homes, which will keep the supply of homes low. It is expected that mortgage rates will remain high in the range of 6-7% for most of 2023, causing affordability to be a significant concern for many buyers. With several prospective buyers expected to remain on the sidelines and the supply of homes to remain low, house prices are expected to remain flat or slightly decrease, depending on the regional market.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.