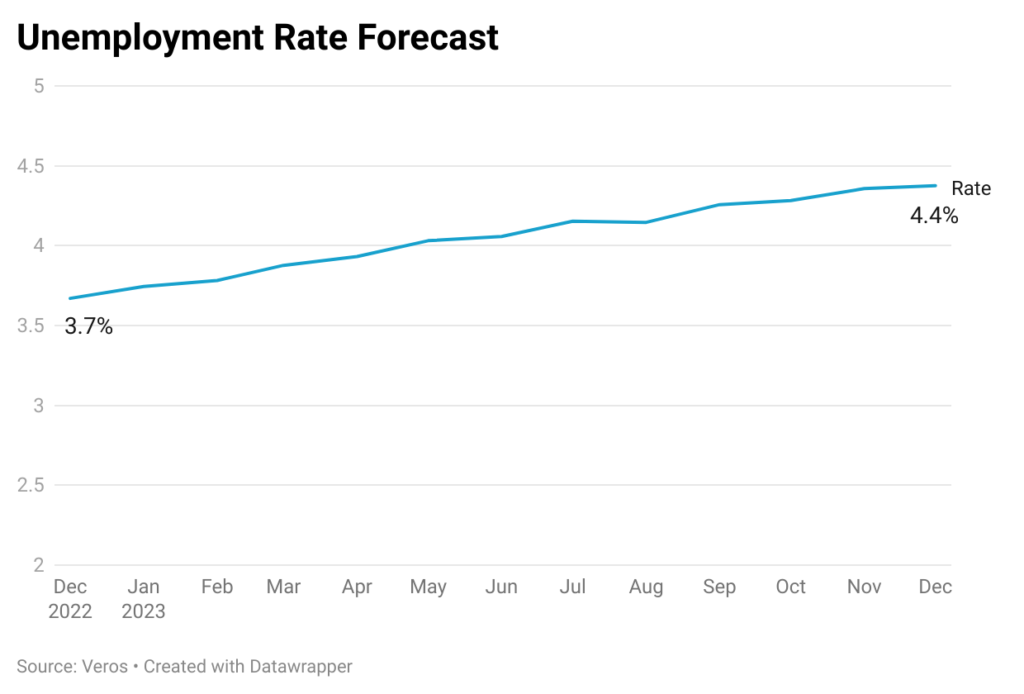

At 3.7%, the US unemployment rate for November was unchanged from the rate in October 2022, while nonfarm payroll employment numbers increased by 263,000. Wage growth was also strong in November at 5.1% from a year ago. Even though the Fed has been aggressively raising interest rates this year, the employment situation has remained quite resilient. However, many experts are anticipating that the labor market will begin to soften as demand retreats in response to higher rates. We are forecasting that the unemployment rate will hold steady at the 3.7% level in December 2022 and will tick up to 3.8% in Q1 2023 and reach 4.4% by December 2023.

The uptick in our unemployment forecast aligns with the softening trends in the labor market. Even though job growth was strong in November, the average for the last two months (274,000) is lower than the average of 539,000 per month in Q1 2022, 349,000 in Q2 2022 and 366,000 in Q3 2022. Further, the Labor Department reported (Job Openings and Labor Turnover Summary) that the number of job openings declined by 353,000 to 10.3 million in October, which meant that the ratio of job openings per available worker declined from 2.0 in September to 1.7 in October. The large number of job openings does not mean that they are spread across all segments in proportion to demand for those sectors. So, a large number of job openings in the leisure, hospitality or education sectors might not be what the recently laid-off tech workers are looking for.

With the job market remaining strong, it is widely expected that the Fed will raise interest rates further, although at a slower pace. While the labor market continues to remain strong, consumer confidence in the economy is declining. The Conference Board’s Consumer Confidence Index declined in November, with consumers indicating lower optimism about the short-term labor market outlook and their income prospects. Since unemployment is only one of the drivers of the housing market, the current forecast for unemployment is not likely to impact the demand for housing in a big way.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.