The 2022 Q3 VeroFORECASTSM predicts that average home prices will appreciate by 1.5% over the next 12 months across the U.S., while some regions are expected to post single digit price depreciations. The housing market cool-off started as mortgage rates started to climb at the beginning of 2022. The 30-year fixed mortgage rate is now close to 7%, a level last seen in the early 2000s. Affordability constraints cooled down demand significantly, ending the housing market frenzy seen in 2020-21. Not only demand but supply has also been impacted as homeowners are preferring to stay on the sidelines rather than sign on to higher mortgage rates.

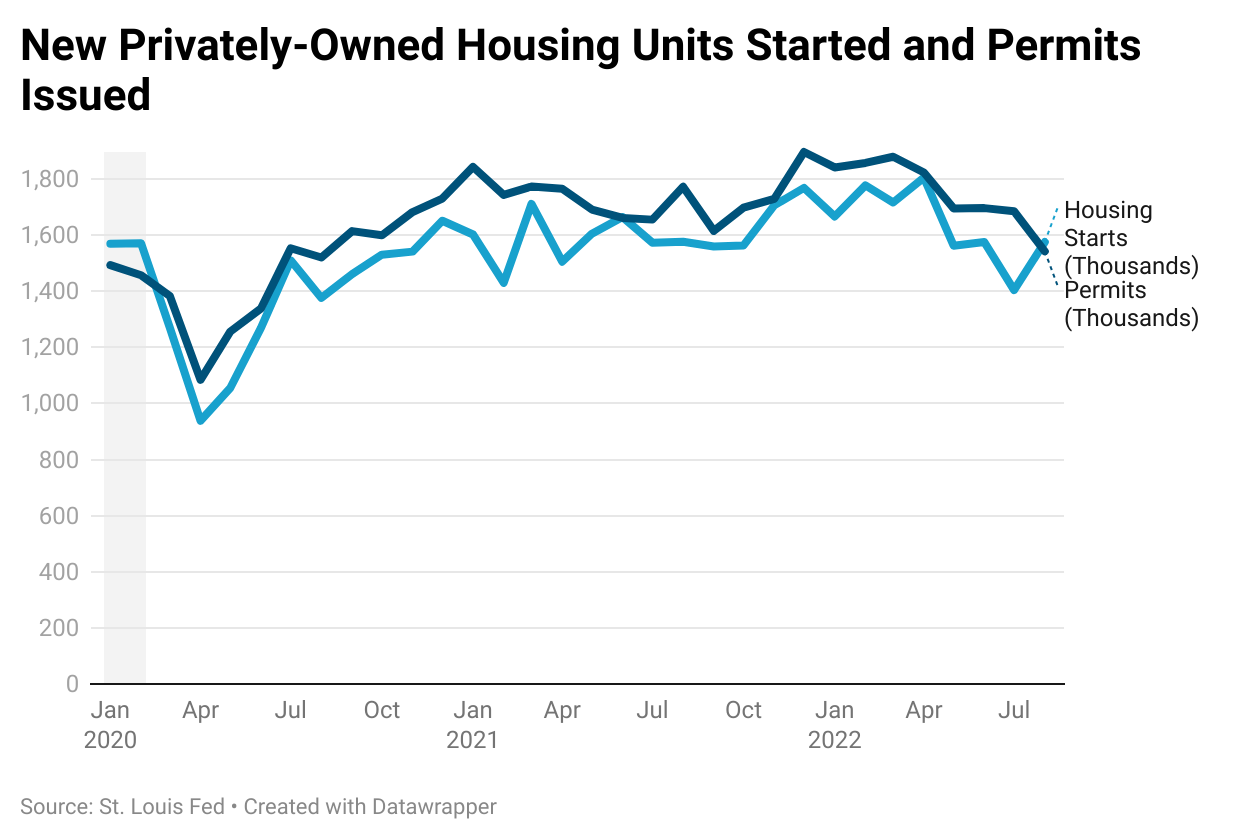

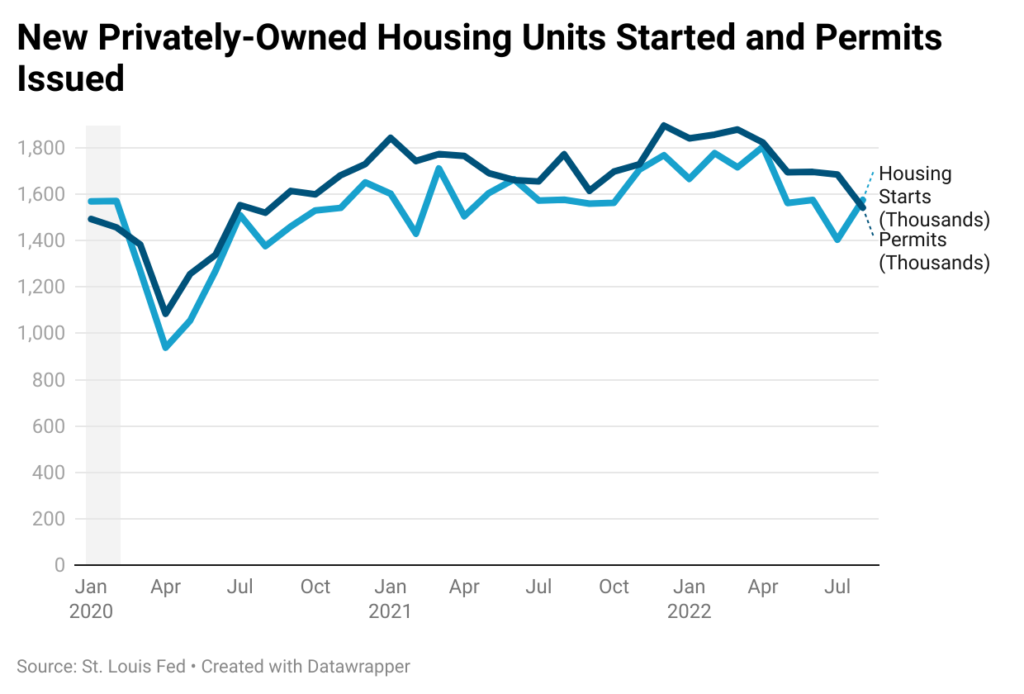

While supply of existing homes is constrained, new construction appears to be weakening. Home builders not only continue to face supply constraints but are also facing headwinds due to economic uncertainty. The National Association of Home Builders/Wells Fargo index that measures builder sentiment decreased to the weakest level in October 2022 since May 2020. The number of housing-starts and permits issued to build new homes have declined compared to the levels seen earlier this year, and are now close to pre-pandemic levels, which implies that the future supply of new homes is slowing down. Within the housing market, construction of multi-family homes has seen a jump, while single-family homes have dropped as soaring rates and high prices are preventing potential homebuyers from purchasing homes. Therefore, we can expect that the supply of homes is not going to rapidly increase anytime soon and will ensure that prices will not depreciate too much.

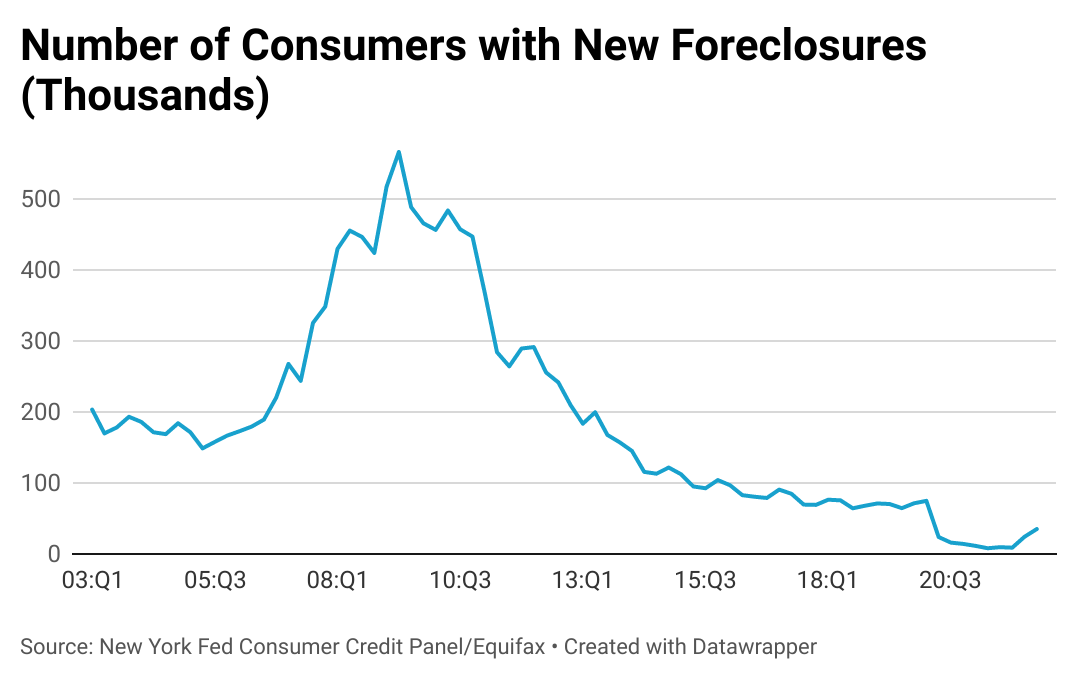

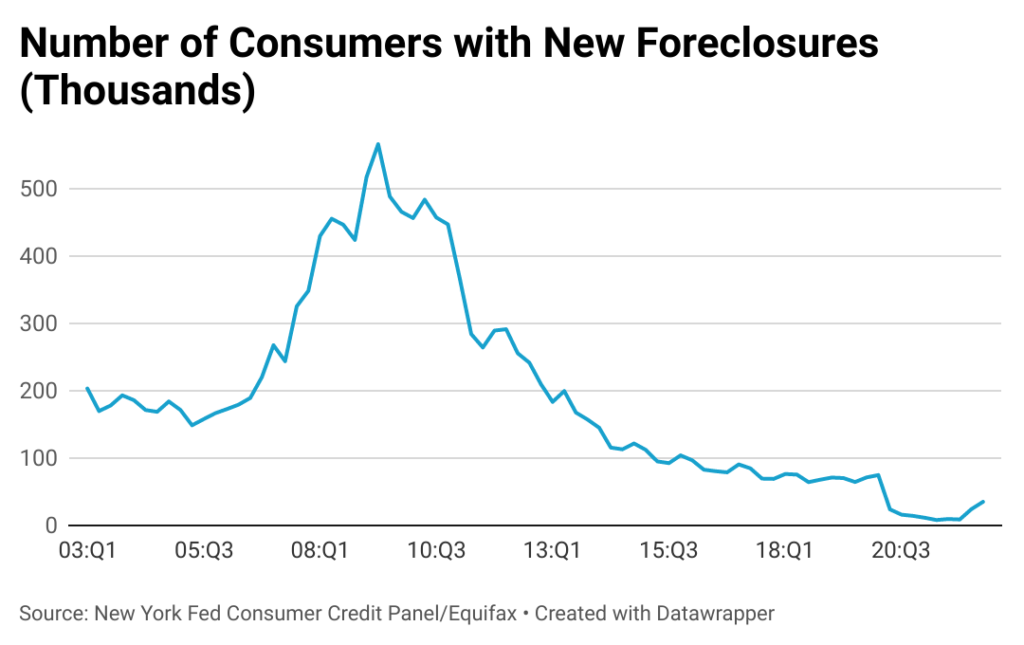

Another determinant of the health of the housing market is the foreclosure rate. In the aftermath of the financial crisis of 2008, the foreclosure rate was around 2.2% (share of housing units with a foreclosure filing). In comparison, the foreclosure rate was less than 0.2% in 2020 and 2021 and even though foreclosures have started picking up in 2022 after the moratorium was lifted, the rate remains low. Additionally, according to the New York Fed, the number of new foreclosures was around 35,000 in Q2 2022, which is much lower than the pre-pandemic level of 74,860 in Q1 2020 and only a fraction of the level seen during the height of the financial crisis (560,000 in Q2 2009). Further, 65% of mortgage originations by value in Q2 2022 were to consumers with a credit score of 760 or more, while just 6.6% were to consumers with a credit score of less than 660. This indicates that consumers are in a strong financial position and even though the number of foreclosures may be rising, these numbers will likely not surge to levels seen in 2008-2010.

Despite the considerable deterioration in housing demand due to higher rates, inflation and heightened uncertainty about the overall economy, homeowners’ balance sheets remain strong and are supported by record low unemployment levels. While most markets are experiencing slowdowns in price or even some depreciation, it remains to be seen how the uncertainty in the economy will play out in conjunction with the housing market fundamentals – an acute shortage of single-family homes and strong demand from millennials who are continuing to form households and waiting for the opportunity to become homeowners.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.