SANTA ANA, Calif., Jan. 3, 2024 —Today, Veros Real Estate Solutions (Veros®), an industry leader in enterprise risk management and collateral valuation services, released its 2023 Q3 VeroFORECASTSM that anticipates nationwide home prices, on average are expected to increase 2.4% over the next 12 months, compared to last quarter’s forecast of a 2.2% increase, signaling a continued rise in prices.

VeroFORECASTSM evaluates home prices in over three hundred of the nation’s largest housing markets, and Veros is committed to the data science of predicting home value based on rigorous analysis of the fundamentals and interrelationships of numerous economic, housing, and geographic variables pertaining to home value.

As we step into the new year, the echoes of 2023’s housing market challenges continue to reverberate, with low supply and unaffordability remaining at the forefront. In its recent December 2023 meeting, the Federal Reserve decided to maintain current interest rates but hinted at three potential rate cuts in 2024. Mortgage rates have already dipped to 6.6% in response, yet predictions suggest they won’t fall below the mid-six percent range. While mortgage rates have dropped by more than a whole percentage point from the highs reached in October 2023, the overall affordability of homes remains a concern. Even when rates were lower than 6.6% during most of the first half of 2023, they failed to entice sufficient buyers or sellers into the market.

While one might expect that mortgage-free homeowners could contribute to the supply, hurdles such as limited options and high prices persist. At least a third of mortgage-free homes are owned by baby boomers and this percentage is expected to rise in the coming years. Warmer climate destinations like Florida, a preferred choice for retirees, have become increasingly costly. Moreover, older Americans are choosing to continue to work and not give up their current lifestyles. Those expecting a tsunami of homes to hit the market as baby boomers retire and downsize will have to wait a while.

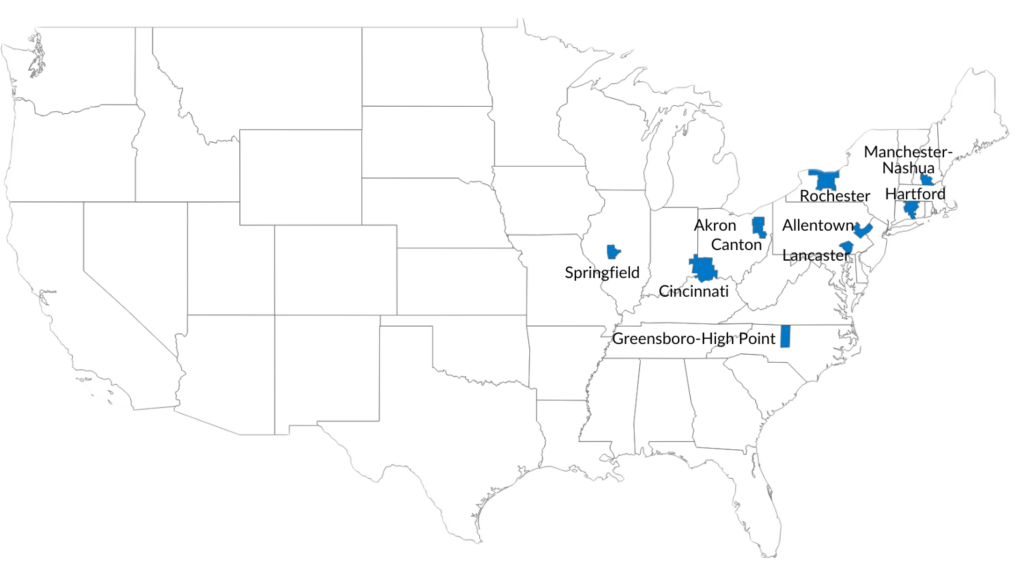

On the flip side, the housing market sees sustained demand, fueled by millennials forming households and first-time buyers eagerly awaiting favorable opportunities. First-time homebuyers are actively exploring affordable destinations, with a particular focus on the northeast and Midwest regions. Cities in these areas still offer not only affordable housing options but also a lower cost of living than in coastal regions, a higher quality of life, promising economic prospects, and family-oriented communities. The rise of remote work has made it feasible for individuals to live in more affordable areas while maintaining employment with companies located elsewhere. Just a year ago, the top-performing markets based on the VeroFORECASTSM were in North Carolina, Nebraska, and Kansas. However, the landscape has shifted, with the latest forecast placing Rochester, NY, as the leading market. Three cities in Ohio, two in Pennsylvania, and one each in Connecticut, New Hampshire, and Illinois feature on the top 10 list. Greensboro in North Carolina is the sole market outside the Midwest or northeast to make the cut. Each of these metros is projected to appreciate in the 5.3% to 7% range.

The 10 Strongest-Performing Markets Over Next 12 Months

| Rank | Markets |

Forecast Data Q3 2023 - Q3 2024 |

|---|---|---|

| 1 | ROCHESTER, NY | 7.0% |

| 2 | AKRON, OH | 6.0% |

| 3 | ALLENTOWN-BETHLEHEM-EASTON, PA-NJ | 5.9% |

| 4 | GREENSBORO-HIGH POINT, NC | 5.8% |

| 5 | LANCASTER, PA | 5.7% |

| 6 | CANTON-MASSILLON, OH | 5.7% |

| 7 | CINCINNATI, OH-KY-IN | 5.6% |

| 8 | HARTFORD-EAST HARTFORD-MIDDLETOWN, CT | 5.5% |

| 9 | MANCHESTER-NASHUA, NH | 5.4% |

| 10 | SPRINGFIELD, IL | 5.4% |

Former worst performers, San Francisco, San Jose, and Seattle are shedding that title and displaying signs of recovery. Five of the worst ten performing cities based on the VeroFORECASTSM are in Texas. Additionally, cities in Utah, Idaho, Louisiana, and Nevada have also found a place among the list of worst performers. The current forecast projects a modest depreciation for each of these ten metros, falling within the range of -2% to -5.5%. This shift in rankings highlights the evolving nature of the real estate market, as some areas previously struggling begin to witness a change in fortunes while others grapple with ongoing challenges.

The 10 Least-Performing Markets Over Next 12 Months

| Rank | Metropolitan Statistical Area (MSA |

Forecast Data Q3 2023 - Q3 2024 |

|---|---|---|

| 1 | WACO, TX | -5.5% |

| 2 | MIDLAND, TX | -4.0% |

| 3 | ST. GEORGE, UT | -3.3% |

| 4 | BROWNSVILLE-HARLINGEN, TX | -3.0% |

| 5 | BEAUMONT-PORT ARTHUR, TX | -2.7% |

| 6 | AUSTIN-ROUND ROCK-GEORGETOWN, TX | -2.6% |

| 7 | LAKE CHARLES, LA | -2.5% |

| 8 | IDAHO FALLS, ID | -2.3% |

| 9 | BOISE CITY, ID | -2.1% |

| 10 | LAS VEGAS-HENDERSON-PARADISE, NV | -1.9% |

VeroFORECAST Methodology

The quarterly VeroFORECAST reports to clients by subscription and to industry media in a summary overview. The current report is based on 312 Metropolitan Statistical Areas (MSAs) data, including 16,594 ZIP codes, 968 counties, and 82% U.S. residents. The report is a projected increase twelve months forward.

- Download the Q4 2023 – Q4 2024 VeroFORECAST results as a PDF infographic or as an infographic image.

- Download the 10 Strongest-Performing Markets graphic only.

Source: Veros Real Estate Solutions

This information is intended for use by the media for economic reporting and should only be used for physical or digital publication or broadcast, in whole or in part, and must be sourced from Veros Real Estate Solutions. The company name must be visible on the screen or website if the data are illustrated with maps, charts, graphs, or other visual elements. For questions, analysis, interpretation of the data, or permission to reproduce, contact communications@veros.com.

About Reena Agrawal, Research Economist

Reena received her PhD in Economics from Vanderbilt University and MA in Economics from the Ohio State University. She has several years of industrial experience in economic research and analysis. Reena recently published two important research reports on “Does Historical Redlining Influence Today’s AVM Estimates?” and “Is There Evidence of Racial Bias?”, and several informative articles.

About Veros Real Estate Solutions

A mortgage technology innovator since 2001, Veros is a proven leader in enterprise risk management and collateral valuation services. The firm combines predictive technology, data analytics, and industry expertise to deliver advanced automated solutions that control risk and increase profits throughout the mortgage industry, from loan origination to servicing and securitization. Veros’ services include automated valuation, fraud and risk detection, portfolio analysis, forecasting, and next-generation collateral risk management platforms. Veros is the primary architect and technology provider of the GSEs’ Uniform Collateral Data Portal® (UCDP®). Veros also works closely with the FHA to support its Electronic Appraisal Delivery (EAD) portal. The company is also making the home-buying process more efficient for our nation’s Veterans through its appraisal management work with the Department of Veterans Affairs. For more information, visit www.veros.com or call 866-458-3767.

Media Contact

Heather Zeller, Vice President of Marketing

communications@veros.com

(714) 415-6300

Original Source via Businesswire